Inhalt

Patrick James

Senior Consultant

Your partner for ERP and technology.

The age of digitization is now! Companies must constantly re-evaluate their processes and the technologies they use. To control processes efficiently, it is necessary to process data quickly and gain valuable insights from it. This is the ideal that is strived for within Digital Transformation. Many companies today are trying to realize this ideal through digitization projects.

From July 1, 2024, electronic invoicing will gradually become the norm for exchanges between VAT-registered companies established in France.Rest assured, the technical and functional constraints and obligations are known, and we are working to quickly offer you a projection towards an easy and pragmatic preparation and implementation path.

The objectives of electronic invoicing:

The objectives of the French government, which have spoken in favor of the introduction of electronic invoicing:

- o Strengthen fraud prevention and control

- real-time insight into economic reality, and better manage economic policy

- Reduce administrative burden

- Reduce payment times

- Increase productivity

- Simplify pre-filling of VAT returns

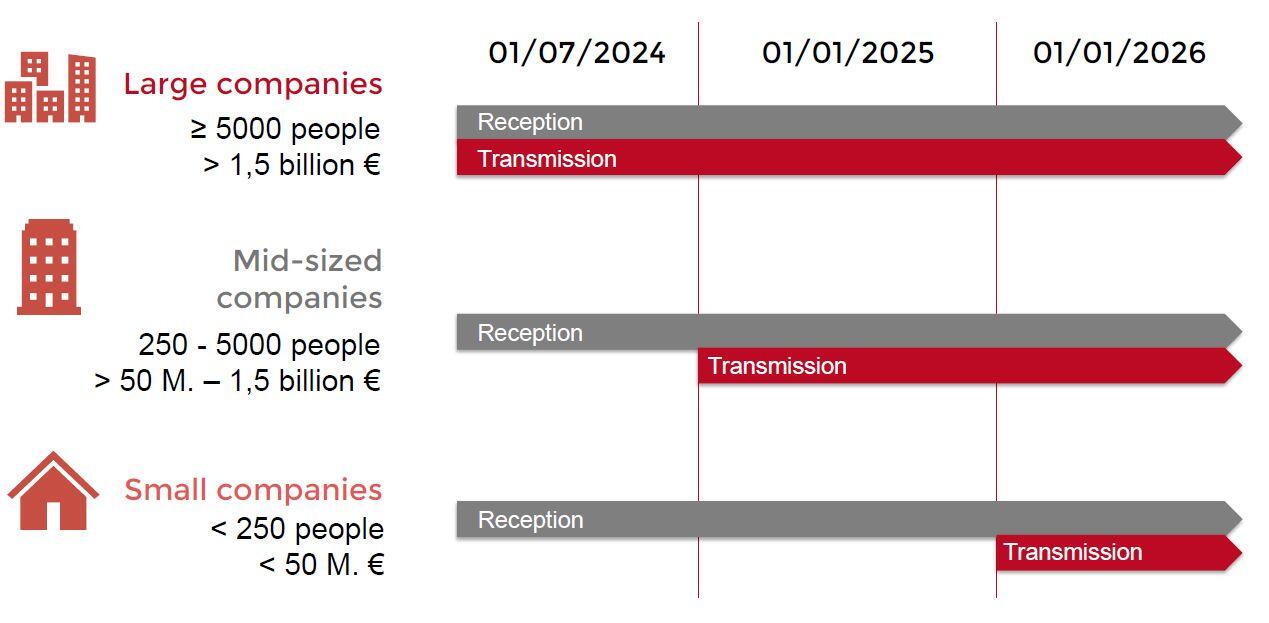

e-Invoicing implementation timetable:

The current timetable for the introduction of electronic invoicing is as follows:

Invoices will no longer be sent directly from the supplier to the customer, but will be transmitted via platforms. Each company will choose the platform of its choice:

- either the public Chorus Pro invoicing portal (currently used for transactions with the state or local authorities, but due to evolve)

- or a private partner dematerialization platform registered with the tax authorities. The list of partner platforms will be available and updated on the website impots.gouv.fr

Please note that the private dematerialization platform partners will not be known before September 2023.

Finance act 2024:MJR supports you through this change:

This reform will have an impact on the organization of your information system, as well as on your ERP.

For this, MJR, alongside its partners IBM, INFOR and InterForm, has set up and is coordinating a technical committee to support you.

The final technical details are expected from the public authorities in the coming weeks, particularly concerning the approved platforms.

Electronic invoice format

The format of electronic invoices has also been specified. Operators of partner dematerialization platforms and the public invoicing portal must transmit electronic invoices in specific formats.

3 types of formats have been defined:

- Cross Industry Invoice (CII) format

- Universal Business Language (UBL)-format

- a mixed format consisting of a structured data file in XML format and a PDF file.

Notice: The recipient’s dematerialization platform operator must take care of formatting the electronic invoice for its customer’s needs.

Invoice status information

Partner dematerialization platform operators and the public invoicing portal must provide their users with information on the status of the invoice concerned:

- „Deposit“ If the invoice has been accepted by the issuer’s platform

- „Rejection“By the sender’s or recipient’s platform if the invoice does not comply with the rules.

- „Refused“ By the recipient of the invoice

- „Cashed“ This status also includes payment data.

Contact us directly!

Marcel Kosel

Sales Manager